Transactions can be external transactions or internal transactions. External transactions involve the business and a third party such as a supplier, they are easier to analyse as there will always be source documents evidencing the transaction. Internal transactions, such a depreciation adjustments, involve only the business itself and may not have accounting source documents. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. We know the paper LBO model will use $300 million in debt financing at a 5% interest rate.

Reliable Outsourced Bookkeeping Solutions

- In five years, our analysis suggests an $860 million exit equity value.

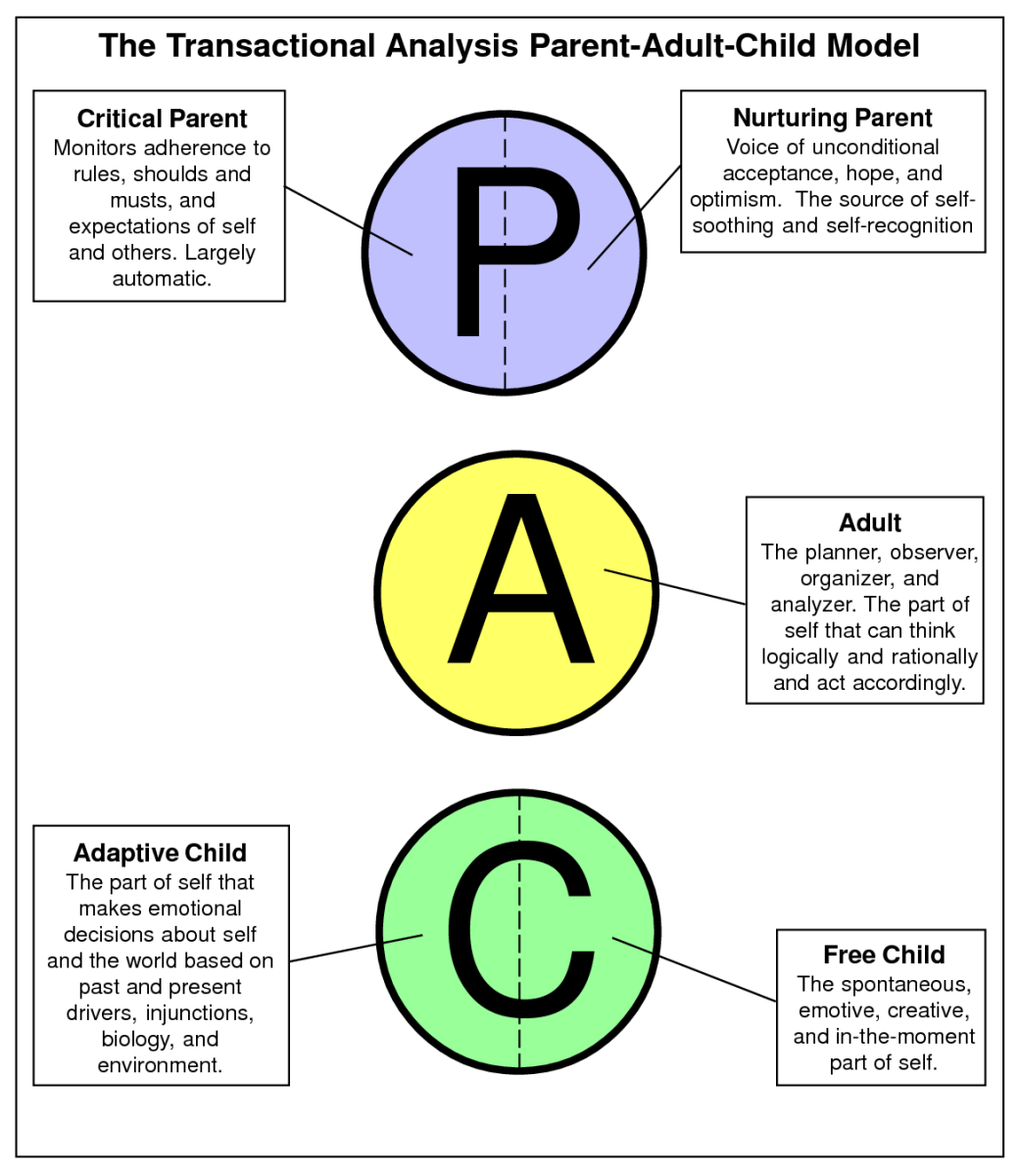

- A nurturing disposition may be helpful in trying to calm situations down or when establishing closer relationships.

- For each scenario, click on the appropriate account category and its related effect (+ or -).

- It’s also customary to quote the various sources in terms of EBITDA.

However, we will review some of the basic and fundamental accounting transactions as a review before we begin an in-depth study of a company’s assets. The basic components of even the simplest accounting system are accounts and a general ledger. An account is a record showing increases and decreases to assets, liabilities, and equity—the basic components found in the accounting equation. Each of these categories, in turn, includes many individual accounts, all of which a company maintains in its general ledger. A general ledger is a comprehensive listing of all of a company’s accounts with their individual balances.

Example of an Accounting Transaction Analysis

Step 4 Do you debit or credit the account in the journal entry? According to the rules of debits and credits, an increase in an asset how to report backdoor roth in turbotax is recorded with a debit. Under the double-entry system of accounting, a transaction essentially involves at least two accounts.

Our Services

Only those events will be given the status of a transaction which can be measured in terms of money and which change the financial position of the business. The equation remains balanced, as assets and liabilities increase. The balance sheet would experience an increase in assets and an increase in liabilities.

The decrease to equity as a result of the expense affects three statements. The income statement would see a change to expenses, changing net income (loss). Net income (loss) is computed into retained earnings on the statement of retained earnings. This change to retained earnings is shown on the balance sheet under stockholder’s equity. Most organizations must gather an enormous quantity of information as a prerequisite for preparing financial statements periodically.

Analysis of Business Transactions

Given that the company received cash and office equipment, both the Cash and Office Equipment accounts will increase. To balance an increase in two asset accounts, we will need to increase the equity account (Common Stock) as well. In the second step, the nature of accounts identified in the first step is determined. For example, in the above transaction of Robert Traders, the cash account is an asset account by nature, and the capital account is an equity account by nature. In simple words, we can say that the cash account is classified as an asset account and Robert’s capital account is classified as an equity account. Most companies typically have numerous transactions to record and track, which requires a more sophisticated system than this simple table.

The Cash account will increase by the exact amount invested by Brian or $55,000. The amount by which we will increase the Common Stock account will equal $55,000 plus $8,850 or $63,850. During the month, Bold City Consulting paid $2,300 cash for expenses incurred, such as salaries (1,350 dollars), building rent (750 dollars), and utilities (200 dollars). Step 3 The asset Accounts Receivable and the revenue Service Revenue are both increased. Bold City Consulting performs $3,150 of services on account. Bold City Consulting borrows $2,500 cash from the bank and signs a two-year note payable to the bank.

Look at the summary of their transaction analysis during a particular time frame. In the above example, the two accounts involved are the cash account and capital account, both of which are increasing. It is not a transaction as it will not change the financial position of the business. It is not a transaction because it will not change the financial position of the business.